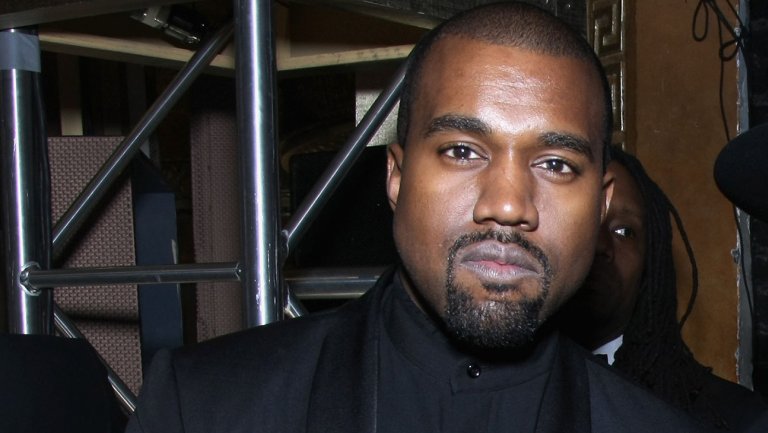

Facing a $10 million lawsuit for not paying up after Kanye West's cancelled a tour, a Lloyd's of London syndicate has hit back with counterclaims that point to insurance policy exclusions pertaining to a pre-existing psychological condition, possession of illegal drugs, prescription drugs not taken as medically prescribed, and the consumption of alcohol rendering the insured unfit to perform.

West filed his suit earlier this month, and in his touring company's complaint, West's cooperation with insurers to demands for information was highlighted. For instance, West submitted himself to an interrogation under oath after checking himself into the UCLA Neuropsychiatric Hospital Center and canceling the second leg of his "Saint Pablo Tour." The goal was to convince the insurers that West's mental breakdown was real, unexpected, and not due to pernicous influences.

In counterclaims, the insurers present a different story.

"Underwriters’ investigation indicates substantial irregularities in Mr. West’s medical history," states the court papers. "Furthermore the insured’s failure to cooperate in Underwriters’ investigation is contrary to the duties of cooperation VGT agreed to as a condition precedent to any obligation of Underwriters to pay any claim arising under the Policies. Throughout Underwriters’ investigation, VGT and its legal, medical and other agents and representatives have delayed, hindered, stalled and or refused to provide information both relevant and necessary for Underwriters to complete their investigation of the claim."

Lloyd's isn't detailing exactly what it uncovered during its investigation. The insurer says it's omitting reference to specific information "in order to protect the privacy of Mr. West from public disclosure of details of his private life."

But in nodding to exclusions, the implications are fairly clear and illustrate where this case is headed.

The defendants are seeking declaratory relief that they have no duty to indemnify West's company because the insuring clause allegedly has not been triggered and is expressly excluded by conditions in the policy. The attorneys handling this for the insurers are Paul Schrieffer and Wayne Hammack at P.K. Schrieffer, who notably were the same attorneys who fought the Foo Fighters after the cancellation of concerts in the wake of frontman Dave Grohl's broken leg and a terrorism attack at a Paris, France nightclub.

In fact, it was the early involvement of legal counsel on the part of the insurance companies that caused West's camp to be suspicious that Lloyd's ever had any plans of paying up. As the original complaint stated, "Immediately turning to legal counsel made it clear that Defendants' goal was to hunt for any ostensible excuse, no matter how fanciful, to deny coverage or to maneuver themselves into a position of trying to negotiate a discount on the loss payment."

This story originally appeared on The Hollywood Reporter.